ASC 842 Multi-Location Lease Amortization Roll-Up & Roll-Forward (Up to 50 Leases) (Premium)

This model will not only allow you to consolidate up to 50 operating leases to confirm your balance sheet presentation complies with the new ASC 842 lease capitalization guidelines, but it will actually provide you with the entries you need to capitalize them on your balance sheet.

This ASC 842 amortization roll-up and roll-forward model creates 842 compliant amortization tables automatically once you enter the basics of each lease (Term, Base Rent, Finance Rate, Incentives and Annual Rent Increase Percentage). No need to line up your amortization tables as this workbook handles all of that for you!

As with the other roll-ups and roll-forwards, this is a critical tool to be able to understand your operating lease liabilities and right of use asset as well as being critical to completing an annual financial audit in support of your balance sheet. The auditors can quickly see the details of each lease and how they all equal your balance sheet totals.

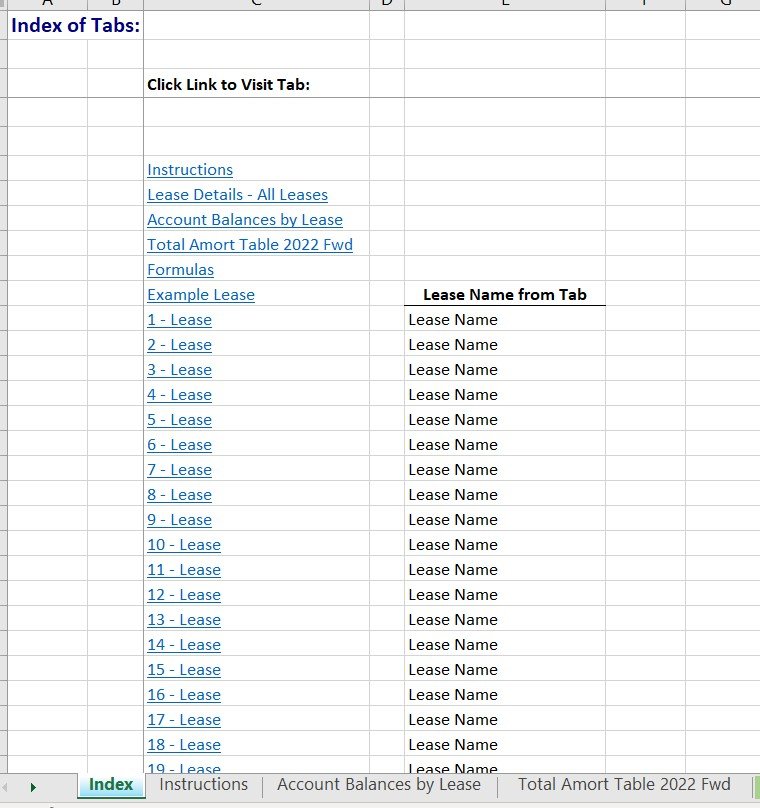

The model includes tabs for: an index to quickly access each tab, an instruction tab to guide you how to use it, a summary of P&L and Balance Sheet totals by lease tab, an example lease, a total amortization roll-up and roll-forward and separate tabs for each detailed lease.

This model will not only allow you to consolidate up to 50 operating leases to confirm your balance sheet presentation complies with the new ASC 842 lease capitalization guidelines, but it will actually provide you with the entries you need to capitalize them on your balance sheet.

This ASC 842 amortization roll-up and roll-forward model creates 842 compliant amortization tables automatically once you enter the basics of each lease (Term, Base Rent, Finance Rate, Incentives and Annual Rent Increase Percentage). No need to line up your amortization tables as this workbook handles all of that for you!

As with the other roll-ups and roll-forwards, this is a critical tool to be able to understand your operating lease liabilities and right of use asset as well as being critical to completing an annual financial audit in support of your balance sheet. The auditors can quickly see the details of each lease and how they all equal your balance sheet totals.

The model includes tabs for: an index to quickly access each tab, an instruction tab to guide you how to use it, a summary of P&L and Balance Sheet totals by lease tab, an example lease, a total amortization roll-up and roll-forward and separate tabs for each detailed lease.

This model will not only allow you to consolidate up to 50 operating leases to confirm your balance sheet presentation complies with the new ASC 842 lease capitalization guidelines, but it will actually provide you with the entries you need to capitalize them on your balance sheet.

This ASC 842 amortization roll-up and roll-forward model creates 842 compliant amortization tables automatically once you enter the basics of each lease (Term, Base Rent, Finance Rate, Incentives and Annual Rent Increase Percentage). No need to line up your amortization tables as this workbook handles all of that for you!

As with the other roll-ups and roll-forwards, this is a critical tool to be able to understand your operating lease liabilities and right of use asset as well as being critical to completing an annual financial audit in support of your balance sheet. The auditors can quickly see the details of each lease and how they all equal your balance sheet totals.

The model includes tabs for: an index to quickly access each tab, an instruction tab to guide you how to use it, a summary of P&L and Balance Sheet totals by lease tab, an example lease, a total amortization roll-up and roll-forward and separate tabs for each detailed lease.